Expert Articles

- All Articles

- Associations Liability

- BindIT

- Claims

- Community

- Design and Construction PI

- Directors and Officers

- Educational

- Featured

- General News

- IT Liability

- Management Liability

- Medical Malpractice

- Partner Solutions

- Professional Indemnity

- Professional Liability

- Public & Products Liability

- Risk Appetite Guide

- SCTP

- Sole Traders ML

- Who We Are

Governance Gone Wrong: D&O Claims in Not-for-Profits and Charities

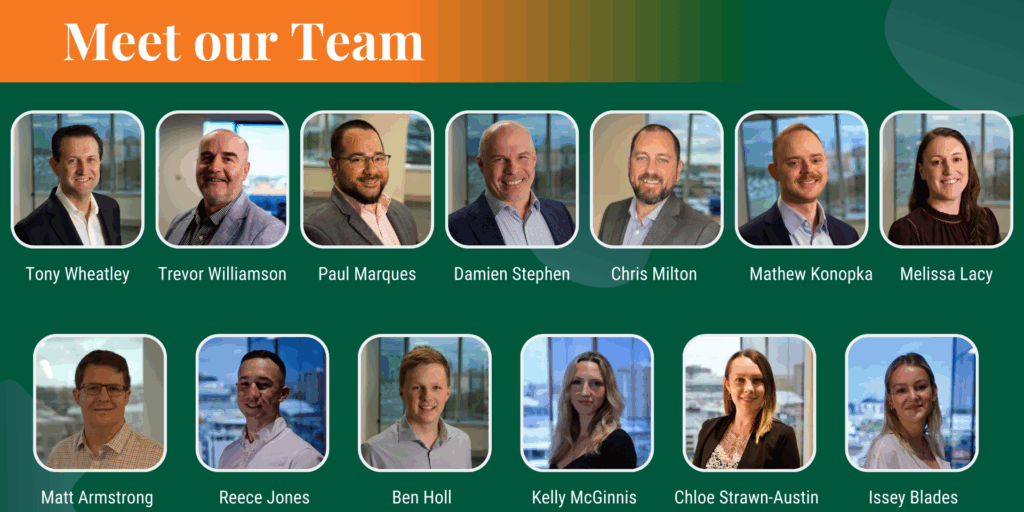

Meet the Team: Claims

Supporting Communities: Berkley Insurance Australia Highlights 2025 Grants Program

Making Every Bind Count: Our 2026 Partnership with Two Good Co

Understanding the Difference between Management Liability and Directors & Officers Insurance

Meet the Team: Sydney Edition

Are you ready for the challenge 2026 has in store?

Why Run-Off Cover Matters: A Critical Consideration for Professional Indemnity Insurance

Inside Berkley Insurance Australia: An Interview with CEO Tony Wheatley