Association Liability Insurance

Association Liability Insurance is a specialised protection package designed for not‑for‑profit organisations, clubs, committees, and professional associations. It combines elements of professional indemnity and management liability insurance to protect individual office bearers and the association for liability to pay compensation relating to claims made against them for wrongful acts for a range of legal and financial risks.

Capacity

$20m

Coverage

*We only provide coverage for unintentional misleading & deceptive conduct, breaches of intellectual property rights and defamation.

-

Any association type

- Unions

- Political parties

GET A QUOTE

Claims Example

Our Insured was a national sporting association. A claimant alleged via that an executive of the Association made defamatory remarks inferring and implying the claimant has misappropriated funds from one of the associations for which she was responsible. These remarks were allegedly distributed widely to various other parties within the association. The claimant sought compensation, an apology and retraction from the executive, and an undertaking that the executive will refrain from making such remarks or inferences in the future. The claimant threatened defamation proceedings in the Supreme Court if the Insured did not comply with their request.

BIA instructed its panel lawyers to investigate and respond to the Concerns Notice and ensure the Insured complied with the fixed time limits and the format of the response as required under the Defamation Act. Following their investigations, panel lawyers found there was sufficient basis to deny liability for alleged defamatory remarks and robustly responded to the allegations. No further communication was received from the Claimant and the limitation period for defamation has since expired.

Costs associated with investigation and responding to the Concerns Notice were covered under the policy.

Frequently Asked Questions about Association Liability Insurance

Management Liability Insurance

Management Liability Insurance will protect Directors and Officers as well as the Company against a Wrongful Act committed in the management of the Company.

Professional Indemnity Insurance provides protection for your business against a claim made by a client alleging they have suffered a financial loss as a result of your negligence or a breach of professional duty from services provided by your business.

Public & Products Liability Insurance

Public and product liability insurance protects businesses from paying compensation to a third party in the event of personal accidents, injury or property damage resulting from any business activity and manufactured or supplied product.

Related Articles

Why Run-Off Cover Matters: A Critical Consideration for Professional Indemnity Insurance

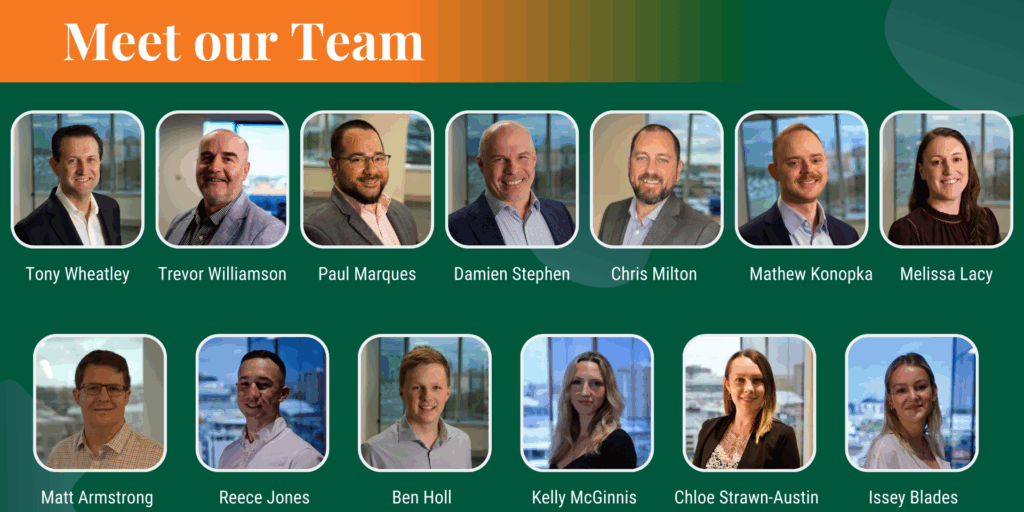

Inside Berkley Insurance Australia: An Interview with CEO Tony Wheatley