Why Is The Insurance Market Hardening

What is a Hard Market?

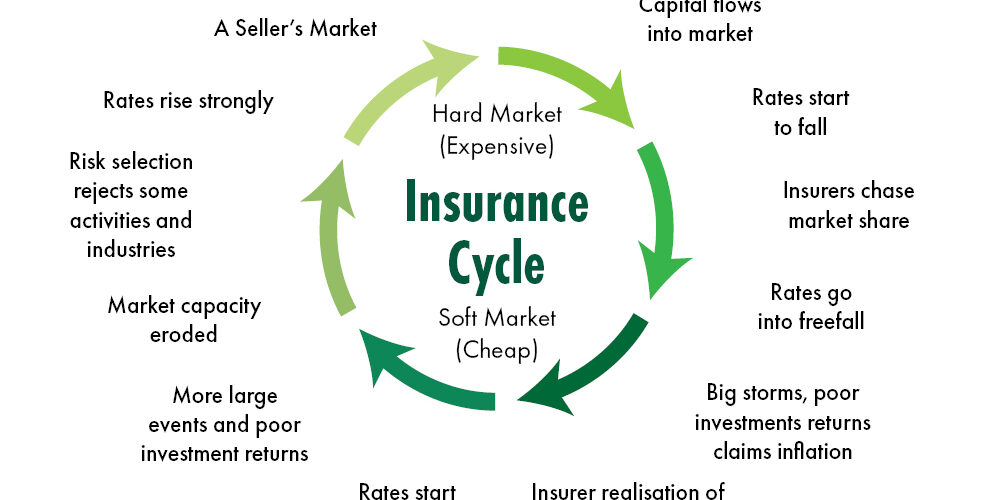

The insurance market is cyclical, moving through both hard and soft markets. A soft market is generally characterised by low rates, high limits and readily available cover. In a hard market premiums, increase and capacity will generally decrease. This can be caused by a number of factors:

• falling investment returns / low-interest rates

• increases in frequency or severity of losses

• reduced capacity

• cost of reinsurance

• regulatory intervention

Low-interest rates mean that insurers can no longer rely on their investment returns to bolster unprofitable results. When interest rates are low insurers focus on underwriting profitability which means raising premiums, tightening underwriting guidelines and being more selective about risk.

In general insurance claims are increasing because of social inflation, which is the societal trend towards increased litigation, broader contract terms, plaintiff-friendly legal decisions and larger jury awards. An example of this is the increased number of Securities Class Actions (think Centro Group, Commonwealth Bank, Takata airbags) seen over recent years.

Why is the Insurance Market Hardening?

Because of significant losses ($1.8 Billion in 2018), Lloyds of London Decile 10 review resulted in a number of unprofitable Lloyd’s syndicates exiting the Australian market resulting in reduced capacity and a retraction in the number of underwriting agencies who have typically participated in the hard-to-place risks.

Reinsurance is the insurance that insurance companies purchase to protect their bottom line. Recent times have seen the cost of reinsurance increasing due to a large number of catastrophe losses around the world. This additional cost is then passed down to the consumer. S&P Global Ratings noted that reinsurers saw property catastrophe rate increases in the range of 15% to 25% in the second half of 2019.

The Marsh Global Insurance Market Index found that commercial insurance pricing increased 11% in the fourth quarter of 2019, while financial and professional lines rose nearly 18% (Marsh Global Insurance Quarterly Report Q4 2019). This suggests that the insurance industry is currently hovering around 9-10 o’clock on the insurance clock pictured above, with rates expected to continue to rise in the foreseeable future.

Related Links

Quote and Bind a Policy Instantly

Insurance Market Continues to Harden with Capacity Dropping

Important Notice

Berkley Insurance Company (limited company incorporated in Delaware, USA) ABN 53 126 559 706 t/as Berkley Insurance Australia is an APRA authorised general insurer. Information provided is general only, intended for brokers and has been prepared without taking into account any person’s particular objectives, financial situation or needs. Insurance cover is subject to terms, conditions, limits, and exclusions. When making a decision to buy or continue to hold a product, you should review the relevant policy documents.

Share this post on

The Importance of Association Liability Insurance for Associations

Professional Indemnity: Common Policy Exclusions

Celebrating a Decade of Partnership with Community Underwriting!