Broker Learning Hub

Want to better understand our products and appetite?

We offer complimentary training sessions tailored to suit your needs. Enquire now and we'll customise a session just for you.

Why Our Brokers Choose Us?

We are a specialist general insurer with a motto of local underwriters supporting local brokers. We encourage our brokers to pick up the phone and discuss their client’s risks so we can work together to find the most suitable coverage solution for the insured.

We consider ourselves a knowledgeable resource with underwriters who specialise in particular business insurance product lines. This enables us to provide a quick and reliable service all the time.

We aren’t an award-winning insurer for nothing!

HOW CAN WE HELP?

Our team of local underwriters are here to help you find the right policy for your needs.

Our goal is to get your clients covered.

Send us a message

Customers Love Us

Don’t take our word for it. Check out what some of our customers have to say.

WHAT WE ARE UP TO?

Your source for our latest news, tips and tricks

Pursuit Underwriting Partners with Berkley Insurance Australia

What is a Miscellaneous Professional Indemnity (PI) Risk?

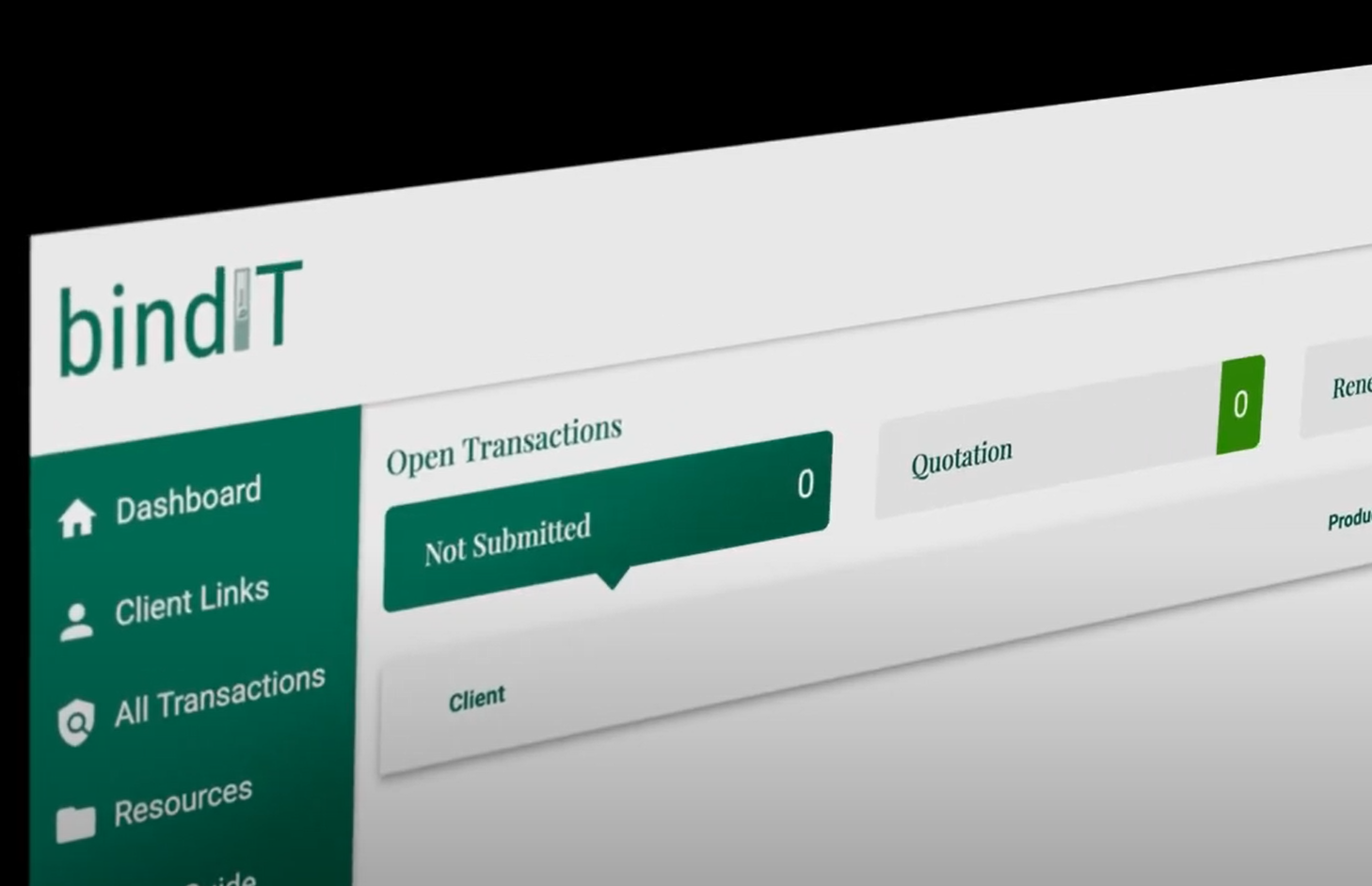

Berkley expands broker portal bindIT to Professional Indemnity

YOUR QUESTIONS ANSWERED

Public and Product Liability Insurance (PPL) protects you and your business against financial loss arising from your legal liability to pay compensation to a third party when they have suffered a personal injury, property damage or an advertising injury. This injury or damage must be in the direct course of your business or as a result of one of your Products.