Contract Insights – Proportionate Liability

The application or exclusion of proportionate liability regimes is an increasingly common contractual issue that Insureds, particularly in the construction industry, need to understand and deal with.

In this article we explore the scope and effects of proportionate liability regimes, as well as the implications of contracting out of these regimes (where this is possible).

A Brief History

So, how did we get to the introduction of proportionate liability regimes? A quick trip down memory lane will assist.

Before the rise of proportionate liability regimes, the common law rule of joint and several liability applied. Under joint and several liability rules a party could recover its entire loss from any one concurrent wrongdoer. In turn, this wrongdoer could then seek contribution or indemnity from other concurrent wrongdoers who had also contributed to the loss or damage. However, if that was not possible (i.e. because the other wrongdoer could not be located or did not have the financial means to contribute), then the first wrongdoer would bear the full burden of meeting the overall liability – even if they were only partly responsible.

The Problem

If you are sensing that under joint and several liability rules plaintiffs would target the wrongdoer with the deepest pockets and underlying insurance rather than wrongdoers with the greatest responsibility, then you are 100% correct.

Target wrongdoers would often bear the risk of recovering from all other wrongdoers and their insurance premium would also experience the greatest upwards pressure.

The Solution

To correct this recovery behaviour, proportionate liability regimes were introduced in all Australian jurisdictions to replace the common law of joint and several liability in relation to claims for economic loss or damage to property.

Generally, under each proportionate liability regime, the liability of each concurrent wrongdoer in relation to an apportionable claim (whether in tort, contract or otherwise) is limited to the proportion of the relevant loss or damage that is considered appropriate, having regard to the extent of the respective responsibility for the loss or damage. Put another way, a defendant who is responsible for 20% of the loss or damage suffered by a plaintiff is only liable to compensate 20% of the loss or damage – rather than the entire loss or damage.

Contracting Out

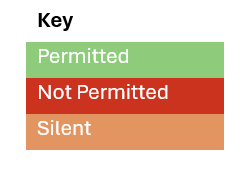

The diagram below illustrates the current position on contracting out from the proportionate liability regime in each Australian jurisdiction.

If the parties are permitted to and do contract out of the proportionate liability regime, then the effect is to revert to the common law rules of joint and several liability. For jurisdictions where the ability to contract out is silent, there is significant risk that contracting out of the proportionate liability regime may be prohibited and inconsistent with the public policy underpinning the relevant regime for the jurisdiction.

Practical Impacts

Where proportionate liability applies, the effect is that a principal will need to pursue all relevant concurrent wrongdoers in order to fully recover the loss or damage they have suffered. Accordingly, if multiple parties have contributed to a loss, the principal would need to pursue all of the parties for their respective portion of the loss. This can result in lengthier and more costly recovery actions. The principal also assumes the risk of non-payment if any of the responsible parties are not able to pay their portion of the loss.

By comparison, where proportionate liability does not apply, the principal only needs to nominate and pursue one defendant for the entire loss, and it is then up to that nominated defendant to attempt to recover against any other responsible parties. If any of those other parties are not able to pay their share of the loss, the nominated defendant will also absorb that loss.

Tips for Brokers

Principals, where possible, are increasingly including clauses in contracts to exclude the operation of proportionate liability regimes. This is because it has significant benefits to them in the event of a loss and taking action to recover that loss, and with the significant number of insolvencies we have seen in the construction industry in recent years, it’s easy to understand why this has become more prevalent.

So as a broker what do you tell your clients when they are asked to sign a contract that includes a clause to contract out of the proportionate liability regime? The best outcome will always be to negotiate removal of the clause. However, if that is not possible, you should reach out to the insurer to ask whether they are prepared to accept the clause. In order to consider accepting such a clause, an insurer will consider several details including where the contract is being performed, the different parties to the contract, and the type of work or project being undertaken. If the clause is accepted, then your client’s policy will be endorsed accordingly.

In circumstances where the insurer is not prepared to accept the clause, you will need to think about whether by accepting such a clause your client will assume a liability under contract that may trigger the relevant contractual liability exclusion in their policy.

A typical example of a contractual liability exclusion clause in a public and products liability policy may be:

“This policy does not cover any liability or obligation of the Insured under any contract or agreement, including indemnity agreements, except for liability which would have existed in the absence of such contract or agreement.”

This means that the policy will generally exclude liability arising from contractual obligations your client has entered into unless the liability would have existed regardless of the contract.

Important Notice

Berkley Insurance Company (limited company incorporated in Delaware, USA) ABN 53 126 559 706 t/as Berkley Insurance Australia is an APRA authorised general insurer. Information provided is general only, intended for brokers and has been prepared without taking into account any person’s particular objectives, financial situation or needs. It is not intended to be comprehensive or constitute legal advice. You should always obtain legal or other professional advice appropriate to your own circumstances before acting or relying on any of the information. Insurance cover is subject to terms, conditions, limits, and exclusions. When making a decision to buy or continue to hold a product, you should review the relevant policy wording.

Share this post on

Governance Gone Wrong: D&O Claims in Not-for-Profits and Charities

Supporting Communities: Berkley Insurance Australia Highlights 2025 Grants Program