Life Sciences Liability Insurance

Life Sciences Liability policies are combined policies including Public and Products Liability, Professional Indemnity and Clinical Trials coverage sections. They are designed specifically for the Life Sciences Industry.

Capacity

$20m

Public & Products Liability

$20m

Clinical Trials

$10m

Errors & Omissions /

Professional Indemnity

Coverage

- Medical Device Companies

- Medical Drug Companies

- Biologic Companies

- Dietary Supplement Companies

- Medical Food Companies

- Cosmetic Drug Companies

- Research Institutions and Organisations

- Life Science Product Development

- Service Organisations

- Life Science Product Testing

- Laboratories

- Medical Product Distributors

- Drug Discovery Technology

- Bioengineering

- Industrial, Marine or Agricultural

- Biotechnology

- Brain and Spinal Implants

- Medical Records Software

- Products with significant off-label use

- Products intended for pregnant women or persons under 18 years of age

- Genetic Testing Products

- Gene Therapy Products

- General Anaesthesia Drugs

GET A QUOTE

Claims Examples

Important Notice

These are examples only. You should read them only as a guide. They do not form part of any policy. Every claim is different. We always determine indemnity decisions and claim payments on an individual basis, after we have assessed the claim. Information provided is general only and has been prepared without taking into account any person’s particular objectives, financial situation or needs. Insurance cover and whether a policy responds to a claim is subject to the terms, conditions, limits and exclusions of the policy. When making a decision to buy or continue to hold a financial product, you should review the relevant policy wording and any applicable endorsements.

Management Liability Insurance

Management Liability Insurance will protect Directors and Officers as well as the Company against a Wrongful Act committed in the management of the Company.

Professional Indemnity Insurance provides protection for your business against a claim made by a client alleging they have suffered a financial loss as a result of your negligence or a breach of professional duty from services provided by your business.

Public & Products Liability Insurance

Public and product liability insurance protects businesses from paying compensation to a third party in the event of personal accidents, injury or property damage resulting from any business activity and manufactured or supplied product.

Related Articles

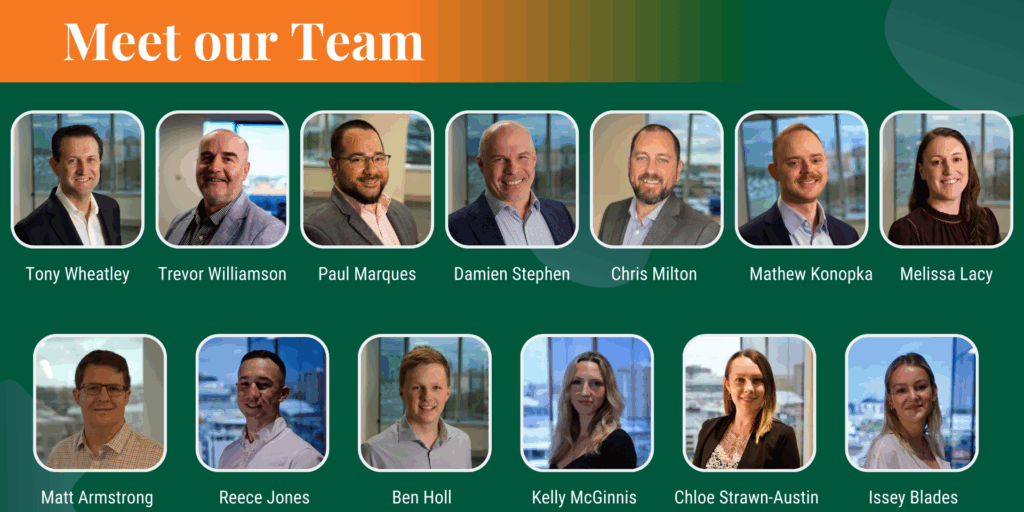

Inside Berkley Insurance Australia: An Interview with CEO Tony Wheatley

Berkley Insurance Australia Wins Specialist Insurer of the Year for Fourth Consecutive Year