bindIT Facts

Berkley Insurance Australia’s innovative portal bindIT automates Professional Indemnity,

Public & Products Liability, Management Liability, and IT Liability. With bindIT, you can conveniently access coverage for a broad range of industries and occupations. bindIT is an efficient end to end policy management tool, that aligns with your local underwriter.

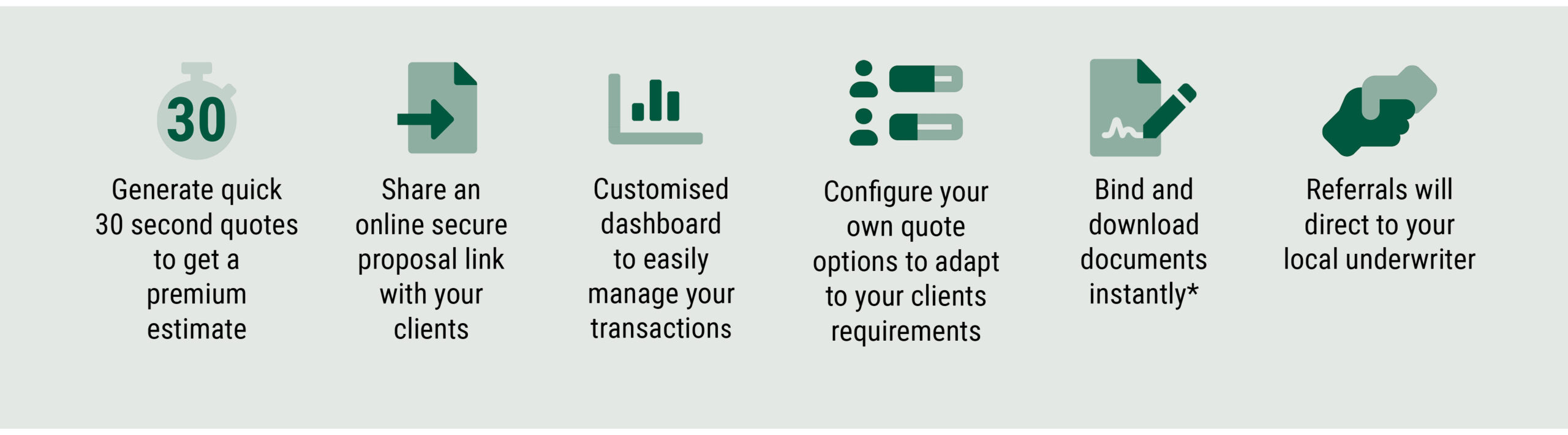

Benefits of using bindIT

PL Premiums starting from $250, PI Premiums starting from $570 and ML premiums starting from $1070 (plus GST & Stamp Duty)+

Automated limits up to $20m

A broad range of industries and occupations

Referrals responded to within 24 hours by your local underwriter

Online Proposal Link for your clients streamlines submission, with direct interaction on bindIT

*We only provide coverage for unintentional misleading & deceptive conduct, breaches of intellectual property rights and defamation.

Professional Indemnity Claims Examples

Important Notice

These are examples only. You should read them only as a guide. They do not form part of any policy. Every claim is different. We always determine indemnity decisions and claim payments on an individual basis, after we have assessed the claim. Information provided is general only and has been prepared without taking into account any person’s particular objectives, financial situation or needs. Insurance cover and whether a policy responds to a claim is subject to the terms, conditions, limits and exclusions of the policy. When making a decision to buy or continue to hold a financial product, you should review the relevant policy wording and any applicable endorsements.

+Application of minimum premium for a particular cover level depends on the risk to be covered and underwriting criteria.

*Instant binding available for quotes that do not require a referral to your nominated local underwriter.

Berkley Insurance Company (limited company incorporated in Delaware, USA) ABN 53 126 559 706 | AFSL 463129 t/as Berkley Insurance Australia (BIC). BIC is an APRA authorised general insurer. Information provided is general only and has been prepared without taking into account any person’s particular objectives, financial situation or needs. Cover is subject to terms, conditions, limits and exclusions. Underwriting criteria applies. When making a decision to buy or continue to hold a financial product, you should review the relevant policy wording.

Management Liability Insurance

Management Liability Insurance will protect Directors and Officers as well as the Company against a Wrongful Act committed in the management of the Company.

Professional Indemnity Insurance provides protection for your business against a claim made by a client alleging they have suffered a financial loss as a result of your negligence or a breach of professional duty from services provided by your business.

Public & Products Liability Insurance

Public and product liability insurance protects businesses from paying compensation to a third party in the event of personal accidents, injury or property damage resulting from any business activity and manufactured or supplied product.

Related Articles

Why Run-Off Cover Matters: A Critical Consideration for Professional Indemnity Insurance

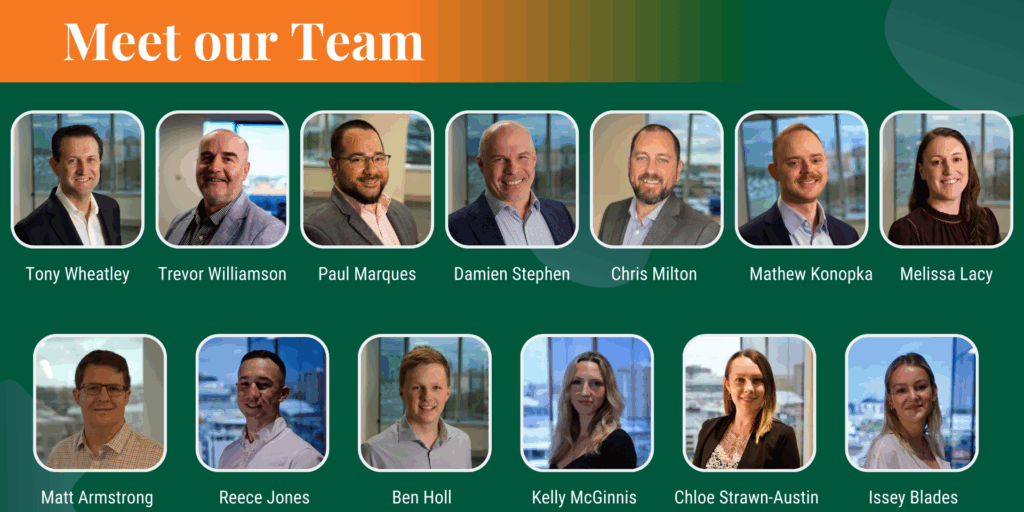

Inside Berkley Insurance Australia: An Interview with CEO Tony Wheatley