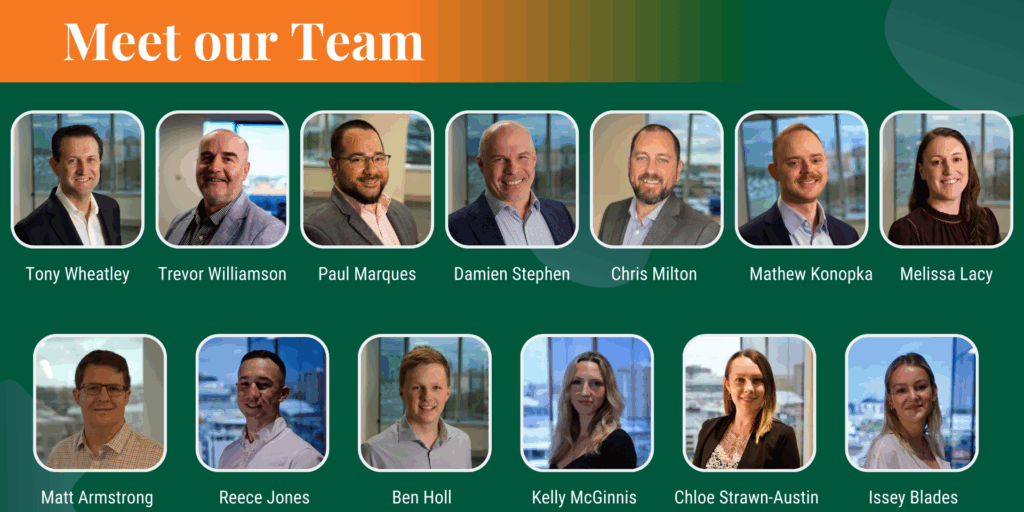

Inside Berkley Insurance Australia: An Interview with CEO Tony Wheatley

Berkley Insurance Australia (BIA) was recently named Specialist Insurer of the Year at the Insurance Advisernet Awards. BIA’s Chief Executive Officer Tony Wheatley shares his thoughts on what drives this recognition, what defines BIA as a specialty insurer, and the priorities for the year ahead.

On what contributed to the award win:

“What contributes the most is the dedication of our underwriters to ensuring we maintain the highest levels of service – answering calls, responding to queries, turning quotes around in less than 24 hours, and generally being proactive in the way they work with brokers, particularly the IA brokers who are reliant on underwriters for assistance,” Wheatley said.

“We have great systems and processes, but without that service focused attitude of the underwriters, these awards would not be achievable.”

On what defines Berkley Insurance Australia as a specialty insurer:

“We have a very focused strategy around our product range and the way in which we want to deliver that to brokers. Our focus on SME in the Casualty/PI space is very different to most of the other insurers in the market and allows us to view everything from the perspective of how we can deliver those products to the brokers in the most efficient way whilst maintaining a high degree of expertise and proximity.”

On the importance of industry recognition:

“I think it’s incredibly important. We often think we are doing all of the right things, but it is great to receive this recognition as reinforcement that brokers actually appreciate what we are doing,” Wheatley said.

“This IA award, our nomination as finalist for the NIBA Award, and our market-beating result in the recent Steadfast survey are strong validation. It doesn’t mean we cannot improve and we need to improve to stay ahead but it is evidence that we starting from a strong position relative to our competitors.”

On priorities for the year ahead:

“Our key priorities for 2026 are to implement some AI tools and give underwriters more time to spend with brokers. We’re looking at ways we can improve the BindIT platform to encourage more brokers to use BIA, update the GL wording with additional benefits, and review our ML product to focus on the core covers brokers and SME clients need.”

“We’ve been successful in attracting some master policy business and need to look at ways they can be done more efficiently for the broker and try to capitalise on that by attracting more.”

“For BindIT, the focus is on expanding the PI occupations, adding the new GL wording, finalising the multi-product quick quote capability, adding some Medical Malpractice occupations, and we are looking at some AI tools that will assist brokers with industry and profession codes selection.”

“Partner Solutions are always on the lookout for new Coverholders and continue to work on expanding the capability of existing Coverholders.”

“We also have a new Head of Claims in Gareth Edwards and expect there will be some meaningful advances in the way we manage our claims.”

“And that is just the tip of the iceberg. There is always a lot happening, and I would encourage everyone to get involved and contribute where they can with ideas and suggestions on how we can continue to deliver true value to our brokers and partners. This will place us in the best position to keep winning these awards.”

Share this post on

Understanding the Difference between Management Liability and Directors & Officers Insurance

Are you ready for the challenge 2026 has in store?