3D Printing – Insurance Considerations

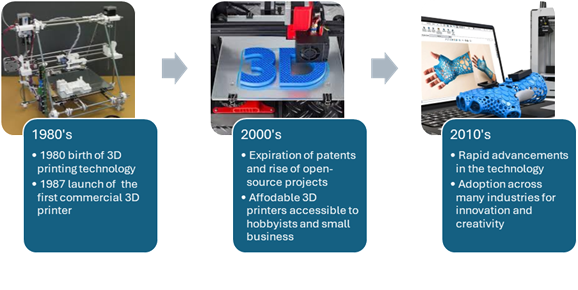

While 3D printing is still seen as an emerging risk, it may be a surprise to some that it has actually been around for more than 30 years.

3D printing is now pushing the boundaries of creativity and is used for a variety of applications and products.

Similar to other new technologies, insurance considerations for 3D printing can be complex and continue to evolve as its use becomes more widespread due to new and novel applications of the technology. In response, insurance policies and legal frameworks are adapting to address the unique risks associated with this technology, which blurs the lines between manufacturers, designers and customers.

Thinking about the exposures

3D printing has decentralised the manufacturing process as it allows individuals to produce products themselves, unlike traditional manufacturing. This can make it difficult to determine who is responsible for a 3D printed product in the event it causes bodily injury or loss or damage to property.

It could be that the manufacturer may be at fault if they used substandard materials or designs, or it may be a case of negligence by the provider of the design if it was flawed or led to the manufacture of a defective product. What about the situation where a person downloads software to 3D print a product at home which then causes injury or damage? Does liability for the product sit with the software provider, the designer of the printer or of the product, or the person who printed it?

Product liability exposure is a significant consideration, especially given the range of industries and products where 3D printing technology can be deployed.

Products currently being produced using 3D printing range from household consumer products such as toys, to medical devices (like prosthetics and implants), as well as firearms (sometimes referred to as ‘ghost guns’), aviation and aeronautical parts or devices, right through to large scale construction projects. The implications for product liability exposures are therefore also broad and varied, making it extremely important to understand some basic aspects of the risk when looking at placing cover for a client using 3D printing in their business.

Some of the important factors to consider include:

- the intended application and use of the products

- whether the insured has a steady product range, or is their range varied and regularly changing

- whether the insured fabricates products based on third party designs, or are they providing the design and fabrication services

The quality of a 3D printed product will also be dependent on the quality of materials used in the process. While we often only think of products printed in plastic, 3D printing can extend to a range of materials, including gold, silver, other metals or composites, even food – 3D printed hamburger, anyone?

There have also been cases involving intellectual property breaches, where a patented product or copyrighted work has been replicated by 3D printing without permission from the owner. Data security may also be a concern where manufacturers are sending data files of designs to people to print, as there is the potential for a file to be hacked and the intellectual property in it stolen.

Tips for brokers

When considering the insurance implications of 3D printing it is important for brokers to:

- identify the use of 3D printing technology in their client’s business;

- to discuss with their client the potential risks they may be exposed to by using this technology; and

- understand the insurance protections their client requires to manage these exposures.

Given the various use cases for 3D printing, the insurance impact will largely depend on how 3D printed products or technologies are specifically integrated into your client’s business. However, as a starting point you should be thinking about impacts across Public and Product Liability, Professional Indemnity, Machinery Breakdown, Business Interruption, D&O, Cyber and Medical Malpractice insurance.

Share this post on

Supporting Communities: Berkley Insurance Australia Highlights 2025 Grants Program

Making Every Bind Count: Our 2026 Partnership with Two Good Co